Marginable equity

Marginable equity is that fraction of the value of held securities against which a financial institution may be willing to lend you money to buy more securities. A security's marginable equity is calculated using this formula:

marginable equity of stock "ABC" = X % of the stock's current price when it exceeds Y

The marginable equity of your portfolio is the sum of the marginable equity of each individual held position. Some stocks are deemed non-marginable, in which case their value is ignored when computing the portfolio's marginable equity.

Important:

Because the value of your holdings can change dramatically, and because the financial institution is free to change the values of X and Y assigned to a security at any time, it's possible that the current margin loan you hold may exceed your marginable equity. When this happens, the financial institution will issue a margin call, requiring you to return that part of your loan that exceeds your borrowing power.

For this reason, buying securities on margin is fraught with risk and (IMHO) should be avoided.

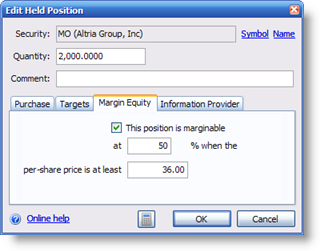

Specifying a held position's marginable equity

To specify a held position's marginable equity:

- In the portfolio view, select the held position and click the Edit toolbar button. The Edit Position window appears. Select the Margin Equity tab.

- Check the box The position is marginable to indicate the position is marginable. Enter the margin rate (X) and minimum price (Y). This information will be available from the lending institution.

- Click OK to save your changes.

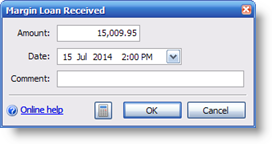

Recording a margin loan

When you a buy a position on margin, you should record the margin loan received to cover its purchase. To record a margin loan:

- In the portfolio view, click the New toolbar button and select Margin | Loan Received from the drop-down menu. The Margin Loan Received window appears.

- Enter the loan amount, the date of the loan and optionally a comment.

- Click OK to record the loan.

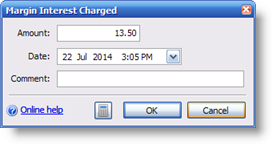

Recording a margin interest charge

To record interest charged against a margin loan:

- In the portfolio view, click the New toolbar button and select Margin | Interest Charged from the drop-down menu. The Margin Interest Charged window appears.

- Enter the amount, the date of the charge and optionally a comment.

- Click OK to record the interest charge.

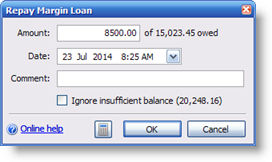

Recording a margin loan repayment

To record a margin loan repayment:

- In the portfolio view, click the New toolbar button and select Margin | Loan Repayment from the drop-down menu. The Repay Margin Loan window appears.

- Enter the amount repaid, the payment date and optionally a comment.

- Click OK to record the repayment.

Created with the Personal Edition of HelpNDoc: Full-featured Help generator